Self-study

This package consists of 6 Accounting related courses.

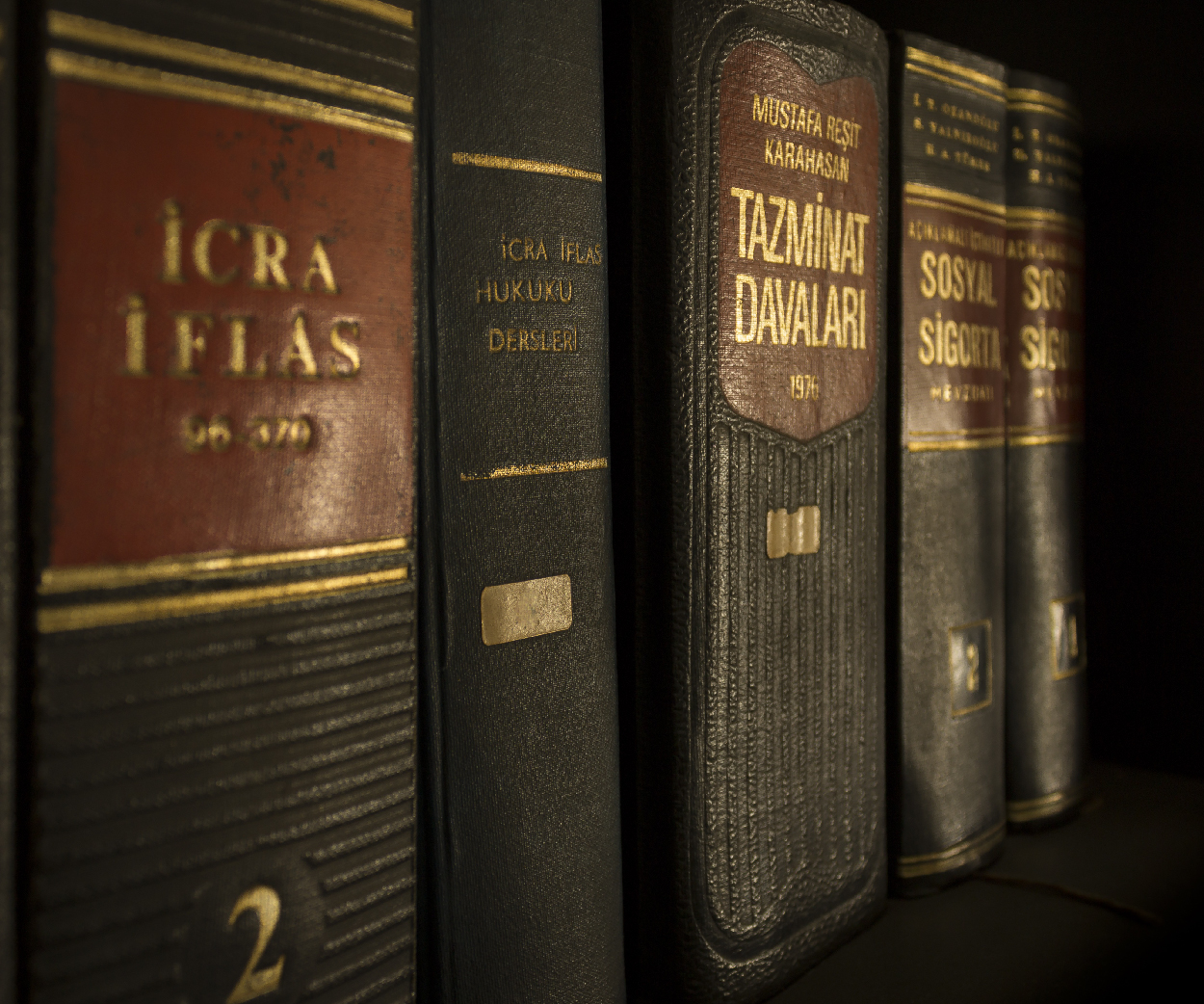

With proper knowledge and a structured application any deceased estate can be finalized with the least amount of difficulty and delay.

The administration of a deceased estate is done within the framework of and in compliance with the Administration of Estates Act 66 of 1965.

The administration of a deceased estate is done within the framework of and in compliance with the Administration of Estates Act 66 of 1965.

There are numerous tax implications when it comes to inheritances; appropriate planning could help you limit the impact of taxation on your estate, and ultimately, the amount of money your loved ones inherit.

This 3-part Masterclass series will assist the learner to broaden the approach to effective estate planning.

This 3-part Masterclass series will assist the learner to broaden the approach to effective estate planning.

The Financial Year End Master self-study package contains 10 courses on various aspects of this final step in a company's financial year and will benefit the learner greatly in achieving this goal.

This course consists of 5 payroll related courses.

This package has been designed to develop a foundation of simple application upon which the complexities of taxation can be built at a later stage. The approach is practical rather than theoretical.

This package is designed to assist the learner or anyone involved with a trust understand the key elements of forming and administering a trust in South Africa. The drafting and compilation of the relevant trust documentation is no simple feat.

Package consists of:

SESSION 1: VAT Introduction & Basic Concepts Course

SESSION 2: VAT Supply & Consumption Rules Course

SESSION 3: Effective VAT Administration Course

SESSION 4: The VAT Reconciliation Course

SESSION 1: VAT Introduction & Basic Concepts Course

SESSION 2: VAT Supply & Consumption Rules Course

SESSION 3: Effective VAT Administration Course

SESSION 4: The VAT Reconciliation Course

This self-study package consists of 13 VAT related courses. Follow the link for more information

The accounts payable process or function is immensely important since it involves nearly all of a business's payments outside of payroll, regardless of size. The object of accounts payable is to pay only business expenses, and invoices that are legitimate and accurate.

The course teaches the three main statements, Income Statement, Statement of Financial Position and Cash Flow Statement, to manage the cash flow cycle from purchases to banking the cash.

This course is designed for entrepreneurs, financial and bookkeeping staff who wish to gain a basic understanding of how the books of account are designed and integrate into business, leading ultimately into the Financial Statements.

The principle of fair labour practice is a fundamental right that is guaranteed in the Constitution of the Republic of South Africa which is the supreme law of the land. Whether you are a small business owner, sole proprietor, partnership or large corporation, if you employ staff you should be equipped with the basics conditions of employment.

This course uses the three main statements, Income Statement, Statement of Financial Position and Cash Flow Statement, to manage the cash flow cycle from purchases to banking the cash. By the end of the course, learners will be able to affectively read and understand the main financial statements, and have a simple understanding of several key figures.

This session is designed to help trustees, practitioners, and compliance professionals navigate South Africa's evolving regulatory landscape. This session unpacks why beneficial ownership matters now, from Financial Action Task Force (FATF) greylisting remediation and Anti-Money Laundering and Countering the Financing of Terrorism (AML/CTF) policy developments to the growing reputational and commercial risks for trustees.

Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. Reconciliation also confirms that accounts in the general ledger are consistent, accurate, and complete. Reconciling your general ledger accounts is part of the bookkeeping process and understanding how they are done, will benefit every bookkeeper greatly.

This self-study course provides insight into how to value a business, as well as a proprietary valuation workbook, that step by step, will explain the theory, and also in a practical way, assist you in calculating the value of your business.

The Commission for Conciliation, Mediation and Arbitration (CCMA) was established to provide the country with an accessible, user-friendly and, above all, inexpensive labour dispute resolution system.

All employers who employ one or more part-time / casual / temporary or full-time employees for the purpose of his / her business / farming / organization's activities must register with the Compensation Fund.

Annually, employers are required to submit the ROE (return of earning) to receive the LOGS (Letter of Good Standing). This course wishes to explore how the process works, as well as how to calculate the ROE.

Annually, employers are required to submit the ROE (return of earning) to receive the LOGS (Letter of Good Standing). This course wishes to explore how the process works, as well as how to calculate the ROE.

Does 50% or more of your total remuneration consist of commission earned?

Did you know that as an employee, you are entitled to claim business expenses against commission income recorded under code 3606, should it be more than 50% of the total remuneration on the IRP5?

Did you know that as an employee, you are entitled to claim business expenses against commission income recorded under code 3606, should it be more than 50% of the total remuneration on the IRP5?

The Company Compliance Course is designed for individuals that are required to fulfil the financial administration function of a business who have no or very little understanding or knowledge of these required functions.